contra costa county sales tax calculator

Del Norte County CA Sales Tax Rate. You can see the total tax percentages of localities in the buttons.

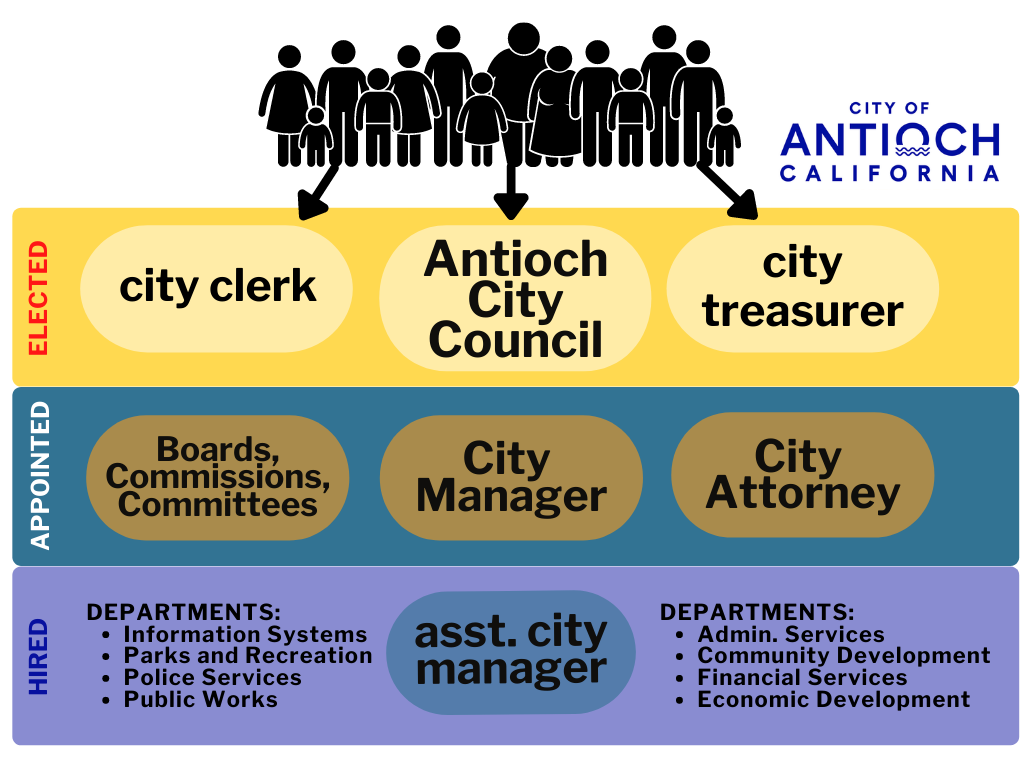

What Is The Structure Of Antioch City Government City Of Antioch California

Calculator Mode Calculate.

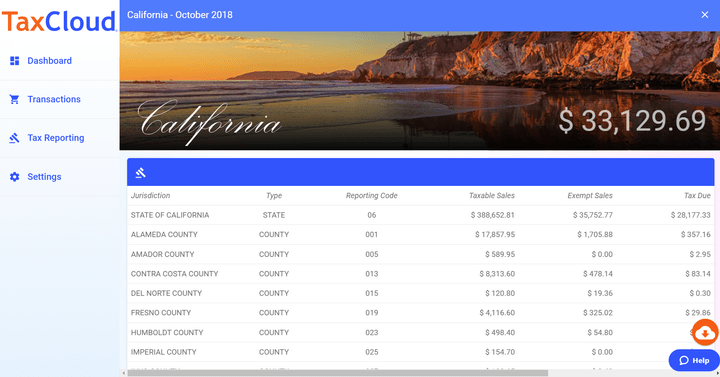

. Income Tax Rate Indonesia. Contra Costa County collects on average 071 of a propertys assessed fair market value as property tax. This county tax rate applies to areas that are within the boundaries of any incorporated cities within the Del Norte county.

The median property tax on a 54820000 house is 575610 in the United States. The contra costa county california sales tax is 825 consisting of 600 california state sales tax and 225 contra costa county local sales taxesthe local sales tax consists of a 025 county sales tax and a 200 special district sales tax used to fund. Choose city or other locality from Contra Costa below for local Sales Tax calculation.

The Contra Costa County Sales Tax is 025. US Sales Tax Rates CA Rates Sales Tax Calculator Sales Tax Table. The base sales tax in California is 725.

The sales tax rate for Palm Springs was updated for the 2020 tax year this is the current sales tax rate we are using in the Palm Springs California Sales Tax Comparison Calculator for 202223. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Bayview Contra Costa County CA.

This table shows the total sales tax rates for all cities and. You can find more tax rates and allowances for Contra Costa County and. The voter-approved bonds that make up the tax rate cannot be changed.

The current total local sales tax rate in Contra Costa County CA is 8750. The median property tax on a 54820000 house is 405668 in California. The 2018 United States Supreme Court decision in South Dakota v.

If you think the value of the property is incorrect please contact the Assessors Office at 925-313-7600. Triple Flip Unwind PDF Sales Use Tax Reference Manual PDF 2021. Sales Tax Calculator Sales Tax Table.

Colusa County CA Sales Tax Rate. What is the sales tax rate in Contra Costa County. You can also use Sales Tax calculator at the front page where you can fill in percentages by yourself.

El Dorado County CA Sales Tax Rate. Contra Costa County has one of the highest median property taxes in the United States and is ranked 72nd of the 3143 counties in order of median. Property Information Property State.

If this rate has been updated locally. Alameda Alpine Amador Butte Calaveras Colusa Contra Costa Del Norte El Dorado Fresno Glenn Humboldt Imperial Inyo Kern Kings Lake Lassen Los Angeles Madera Marin Mariposa Mendocino Merced Modoc Mono Monterey Napa Nevada Orange Placer Plumas Riverside Sacramento. 2007 Contra Costa County Treasurer and Tax Collector.

The December 2020 total local sales tax rate was 8250. Ad Download Avalara rate tables each month or find rates with the sales tax rate calculator. Delivery Spanish Fork Restaurants.

Contra Costa County Sales Tax Calculator. If the special assessments are incorrect please call the phone number listed to the right of the special assessment. Puerto Rico has a 105 sales tax and Contra Costa County collects an additional 025 so the minimum sales tax rate in Contra Costa County is 625 not including any city or special district taxes.

This is the total of state and county sales tax rates. The Contra Costa County sales tax rate is. Sales tax in Palm Springs California is currently 875.

1788 rows California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated. This is a custom and easy to use sales tax calculator made by non other than 360 Taxes. The California state sales tax rate is currently.

The December 2020 total local sales tax rate was 8250. The Contra Costa County Sales Tax is collected by the merchant on all. Contra Costa County CA Sales Tax Rate.

The Contra Costa County California sales tax is 825 consisting of 600 California state sales tax and 225 Contra Costa County local sales taxesThe local sales tax consists of a 025 county sales tax and a 200 special district sales tax used to fund transportation districts local attractions etc. Real property tax on median home. The minimum combined 2022 sales tax rate for Contra Costa County California is.

Soldier For Life Fort Campbell. Sales tax data for California was collected from here. SEARCH BY PROPERTY ADDRESS.

The minimum combined 2022 sales tax rate for Contra Costa County California is. You can also contact the districts directly at. 2021 - Quarter 4 Not yet released 2021 - Quarter 3 Not yet released 2021 - Quarter 2 PDF 2021 - Quarter 1 PDF 2020.

How much is sales tax in Palm Springs in California. This tool can calculate the transferexcise taxes for a sale or reverse the calculation to estimate the sales price. The total sales tax rate in any given location can be broken down into state county city and special district rates.

Some cities and local governments in Contra Costa County collect additional local sales taxes which can be as high as 45. Sales Tax State Local Sales Tax on Food. This calculator can only provide you with a rough estimate of your tax liabilities based on the.

Contra Costa County in California has a tax rate of 825 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Contra Costa County totaling 075. A county-wide sales tax rate of 025 is applicable to localities in Contra Costa County in addition to the 6 California sales tax. Essex Ct Pizza Restaurants.

For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage. The median property tax in Contra Costa County California is 3883 per year for a home worth the median value of 548200. The median property tax on a 54820000 house is 389222 in Contra Costa County.

Heres how Contra Costa Countys maximum. AZ CA HI NV OH OR WA. The median property tax on a 54820000 house is 405668 in California.

Choose Avalara sales tax rate tables by state or look up individual rates by address. Restaurants In Matthews Nc That Deliver. To find out the estimate on a Property Tax Bill key in one of the following then click on the corresponding Find button below.

SEARCH BY PARCEL NUMBER APN Parcel Number Eg. Opry Mills Breakfast Restaurants.

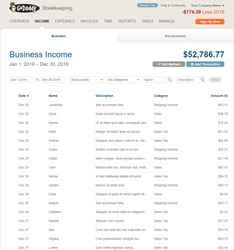

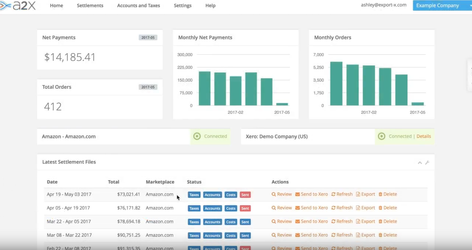

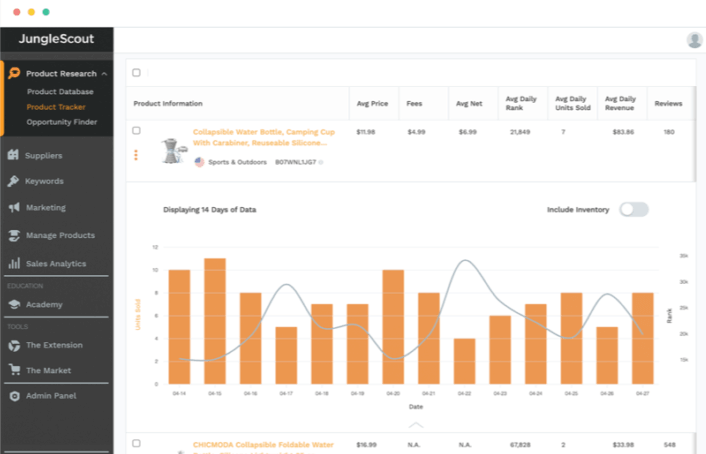

20 Best Accounting Software For Amazon Sellers Of 2022 Reviews Pricing Demos

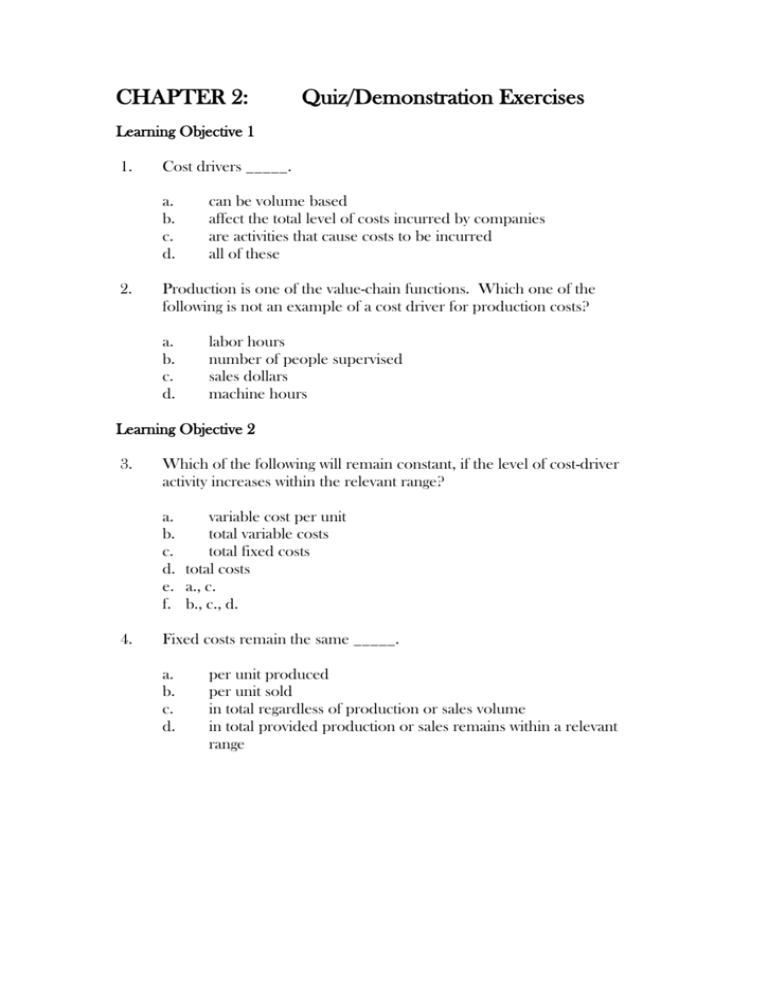

Consultant Tax Calculator Independent Contractor Tax Brackets

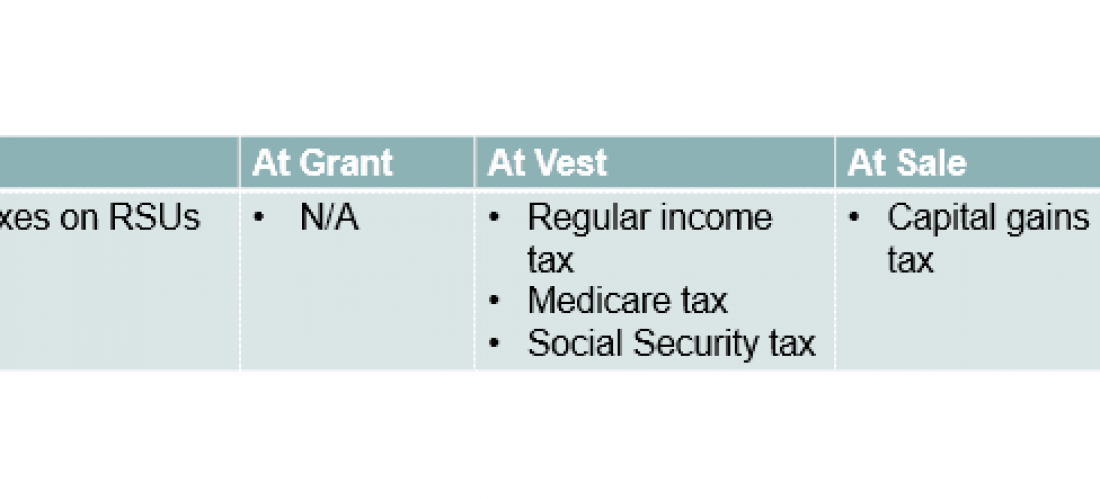

Equity Compensation 101 Rsus Restricted Stock Units

D Shaun Maddeauxn X 1withdirt Twitter

Divorcing In California 3 Separate Property Reimbursement Rights You Need To Know Family Law Matters December 3 2019

Niagara County New York Property Taxes 2022

20 Best Accounting Software For Amazon Sellers Of 2022 Reviews Pricing Demos

City Of Union City California Facebook

California Sales Tax Rate Changes In July 2022

Secure Act Tax Credit Calculator Myubiquity Com

20 Best Accounting Software For Amazon Sellers Of 2022 Reviews Pricing Demos